Our previous two interviews with Paul Mullen, General Manager of displays specialist Anders, have revealed new perspectives on the exciting display technologies that we expect to see making a big impact in the next generations of high-tech products. Now, Paul moves on to discuss the practical and commercial factors that may potentially restrict the pace of progress but, if managed sensitively, can turn obstacles into opportunities.

At Anders, we are not only intensively engineering focused, but are also closely involved in supplying the components and subsystems our customers need to build their creative new products. Managing the supply chain is a perennial challenge, and it’s absolutely vital that the required parts are delivered on time. Clever logistics is about keeping the supply chain healthy, and to achieve this we not only need to listen to our own manufacturing partners but also keep a close eye on new technologies, end user markets, and global economic and political changes. We need to anticipate events and plan ahead to handle any issues that could challenge our ability to supply.

In addition, there are always natural peaks and troughs in terms of manufacturing cycles, leadtimes and market demand, and these are particularly prevalent in markets for highly competitive consumer technologies. Fortunately, in the markets we tend to serve, we are not highly exposed to the most volatile of these, such as cutting-edge consumer-oriented memory chips. The industrial memories our customers tend to rely on are typically “trailing-edge” technologies that have a higher ASP and are less susceptible to fluctuations in market demand.

Ensuring continuity of supply

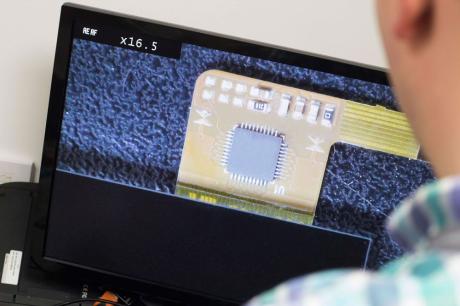

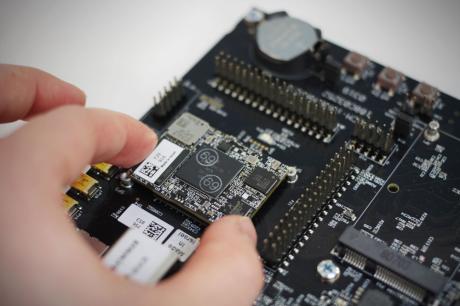

On the other hand, the supply chain can be more adversely affected by problems related to ICs based on older wafer technologies, as fabs obviously put more energy into moving high-volume products at the latest nodes. Sourcing “commodity” parts like certain types of resistors and capacitors can also often present severe challenges. Lead times can change unexpectedly, and we need to be creative to handle this.

It can take a combination of measures including closer coordination with customers to ensure accurate planning, keeping larger buffer stocks, and, where possible, rationalising the numbers of different components used. Rationalisation is happening naturally in the application processor market at the moment, as a number of established chip vendors are quitting to concentrate on consumer opportunities. This is causing companies like Anders to move towards platforms such as NXP’s i.MX family. While demand for these parts in the industrial space is naturally increasing as other processor vendors such as Marvell and TI quit, it is also true that we can focus on managing supplies of those parts more closely.

What about leadtime and currency fluctuations?

To handle the fluctuations in lead times, I would say that where we may have looked to keep critical key component buffer stocks of about 12 to 14 weeks in the past, it’s more prudent today to keep for 14 to 18 weeks. In addition to managing buffer stock, we can put additional services in place, such as rescheduling, to help customers manage fluctuations.

Another important aspect that can fluctuate, and which has a major effect on the bottom line, is currency. This is closely linked to political as well as economic factors, and of course one of the biggest political issues as we speak is Brexit. I have to say, I have not seen a great deal of currency uncertainty that can be directly attributed to the political stalemate, although the situation is certainly frustrating. At least 70% of our business is transacted outside the UK, and is therefore in non-sterling currency. There is little to be said about Brexit from a financial point of view, right now, although we have taken steps to protect ourselves against potential problems, for example by setting up a trading entity in the Netherlands.

On the other hand, Brexit may have a significant impact on our employee base, many of whom are natives of EU countries. We are working with them to try and understand how the situation regarding free movement may change and how we can be sure to take care of them.

Eastern Europe is an important manufacturing destination

On the Eastern side of the continent, things are changing more profoundly. Eastern Europe has grown in importance as a manufacturing destination over the last decade or so, successfully winning CEM business from China, in particular. This has been the spearhead of a kind of “re-shoring” trend by OEMs who prefer to keep manufacturing close to home and now see the opportunity for it to make total landed cost economic sense in Eastern Europe as costs in the Far East are rising. We are also seeing some low-volume, high-value contracts move towards Eastern Europe from the west. It’s becoming an increasingly powerful destination both for cost-sensitive and quality-conscious work.

What about the rest of the world?

China, for its part, obviously remains extremely strong as a CEM destinantion as well as the growth engine for display capacity growth. It’s obvious the government artificially supports certain types of companies; display companies being one example. We expect some consolidation among Chinese display companies soon. India, also, has been suggested as a potentially attractive manufacturing destination, having in its favour a skilled and educated workforce and a government keen to encourage inward investment.

Still, however, the bulk of investment in India is going to the end product R&D side, and not so much towards building a component based or sub-assembly manufacturing powerhouse. In contrast, we are engaging more and more with new manufacturing opportunities in Latin America, and there is also some exciting opportunities in northern and southern Africa. We see huge passion for education, and a thirst for continuous improvement there. Coupled with a much younger population, compared to, say, Europe or North America, there is potential for really dynamic growth that could be highly disruptive to the other geographies, so we at Anders are watching and learning to see where we can fit in these geographical landscapes.

At Anders , through the ages, what we have learnt is that change is a business cycle. There will always be challenges, market influencers and industry disruptors, but it’s how you manage change that enables you to compete efficiently for more than 65 years! So, although the world presents us with familiar tests, the tools we have at our disposal today give faster access to better information, and more powerful analytics, to make the most of opportunities and foresee potential threats, preparing more effectively to handle them.

Get in touch to learn more about how we simplify your LCD display and embedded systems supply chain!